Tax Exemption For Creatives? New Model Proposed

A tax break to help boost the financial stability of the creative sector is being mooted - we break it down.

There has been an overwhelming call from the creative community for years that when it comes to income - someone’s got to give artists a break.

That’s exactly what’s been suggested in a push for tax exemption scheme for the arts, culture and creative sector.

Tāmakai Makaurau arts advocacy organisation Te Taumata Toi-a-Iwi are in the early stages of a proposal that could have a significant impact for many artists across Aotearoa - and are calling for feedback to further solidify their findings.

While pleas for an artist wage or the much-opined return of the PACE scheme have been largely ignored by successive governments from across the political spectrum, this new approach is a new chance to stake a claim for more financial stability across the sector - one its author says is proven internationally.

What is the plan?

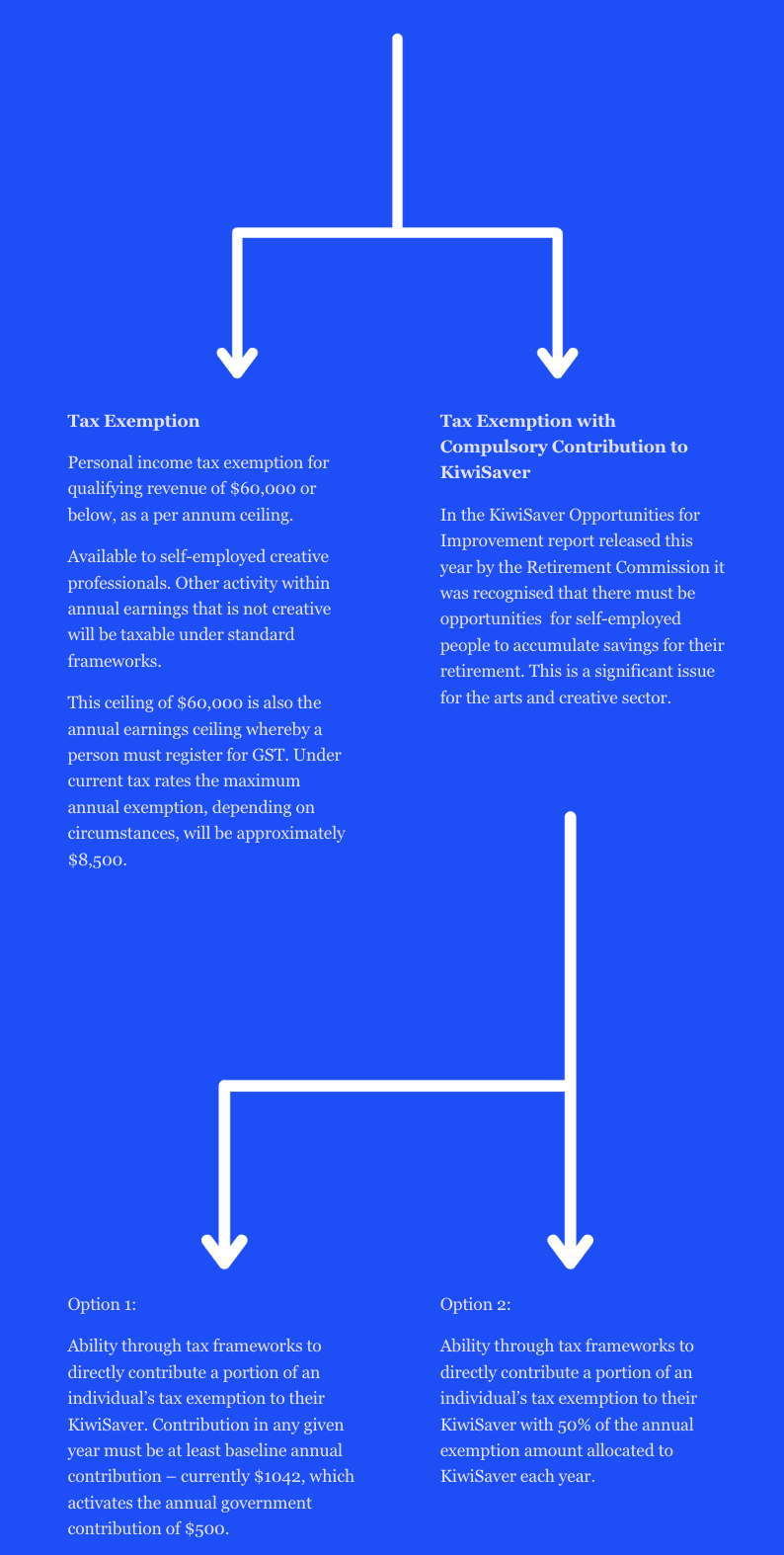

On its Arts Action Now website - a collaboration with the Regional Arts Network Aotearoa (RANA) - Te Taumata Toi-a-Iwi state “We are proposing a Tax Exemption model for creative practitioners in New Zealand along with a couple of supplementary options that include KiwiSaver.

“This model has been designed to keep administration as simple as possible and to enable participation to occur within a single tax return scenario. This model uses processes that are currently part of completing either a tax return or tax registration.

“In short - the changes proposed in this model will operate within the existing framework. No new elements will need to be funded or built.”

Here's how they break it down:

The proposal states that while the benefits of this proposed new tax model will include economic development and helping to generate tax revenue - it will also highlight value to the creative sector.

Among its listed examples:

- Retaining talent

- Recognition that creative work has a value

- Programmes are based on generation of economic and business activity; not grants and funding

- Recognition and enablement of indigenous creativity and culture

- Increased wellbeing for creatives and their communities

- Helping establish new creative careers and growing creative workforce

Rhode to success

Much of the model has been based on what has worked overseas, with usual comparison benchmarks Ireland (with its long established Artists Exemption scheme) and Australia (where creatives and sportspeople have benefited from a Special Professionals framework for decades) among those included in the research.

But perhaps the most impressive case study comes from the United States, where Rhode Island, New York.

Its Sales Tax Exemption for Artists was established a decade ago - focussed on the sale of original creative works such as books and other writing, plays, music, visual arts, film and dance. Of the 45 US states that have a general sales tax, Rhode Island is the only one with an exemption scheme for the arts, developing it a reputation as the “State of the Arts”.

In 2022, 704 artists claimed a total of $15.59 million in sales of tax-exempt art sold in Rhode Island from 216,448 individuals’ artwork.

Interestingly, the research underlines that areas that have introduced tax exemption programmes for creatives have not been met with a simultaneous reduction of funding and services.

Floor is open

The concept of paying tax on their creative earnings could be daunting to some - given the nature of the industry, sales from marketplaces or from developed personal contacts regularly fall into the 'cashies' category that many tradies use to work around declared income.

But for those wanting to make the arts their profession rather than just a 'side-hustle', or for those whose work is done with theatre companies, galleries or venues where everything is on the books - this style of exemption could be music to their ears.

Whichever end you sit on the financial scale and approach, Te Taumata Toi-a-Iwi states they want your input.

Creative Catalyst Jane Yonge poses "Advocacy is a collective action and change can be made through public discourse, opinion and feedback. We value what the creative sector thinks about this kaupapa.

"Does this idea make sense? What works and what doesn’t work? What are the blindspots we perhaps may not have considered? Will this actually make a difference to your career and life?"

The feedback portal on the Arts Action Now website gives you the chance to help contribute before this proposal is put forward to government.

(Top Photo: StellrWeb/Unsplash)