This is how you get your finances in order!

Written by

This is the bit of making a living from art that nobody likes to engage with - the finances. But, in the long term, it’s much better to be on top of them. Being on top of your finances might involve a bit of paperwork and planning, but not being on top of them might involve going broke. I don’t know about you’ but I prefer the first option to the second.

So with this in mind, I caught up with Mike Denford. Mike’s a CPA with years of experience working in and around finance in all kinds of businesses. He’s a mentor in Mentoring In the Arts Program run by The Big Idea. Here’s the insight Mike gave me about handling the finances as an artist.

Set some income goals

For lots of artists, the big pain point is from the irregular nature of your income. It’s not like a regular job, where you’re paid every two weeks, just like clockwork. But here’s the problem: expenses are regular. Rent is due every week, and you need to eat every day.

To get on top of this, you should do a bit of planning. Figure out how much money you need each month just to cover your minimum expenses - your rent, your utilities, your transport costs and your food, and anything else you need to buy every month. Once you’ve figured this number out, you can set some goals around your income.

Of course, that doesn’t immediately make the work materialise in front of you. But it gives an idea of how much you need to be working each month, and whether you need to supplement your art income with a day job.

Keep an eye on the cash

Cash is king in business, and as an independent artist, you are essentially a business. Not only should you be trying to make enough each month to cover your expenses, you should also have enough on hand to cover expenses.

This is a subtle, but important difference. Let’s say you’re an actor who needs a minimum of $1,000 a month to live. On the first of the month, you get a voice acting job that pays $1,500. Great! You covered this month’s expenses and half of next month’s.

Just one thing, though - the voice acting company doesn’t pay until the 20th. So until then, you have nothing.

In an ideal world, you would always have enough cash to cover your monthly expenses.

In an ideal world, you would always have enough cash to cover your monthly expenses. I know- we don’t live in an ideal world. So the next best thing is to keep a close eye on when you can expect cash to come in and when you can expect cash to go out. This can be a spreadsheet, or even something as basic as a bit of paper. The key is to know when your payments are due - such as rent and utilities - and to also know when your money’s coming in. “The more planning and forward thinking you have around cash forecasting, the better,” says Mike.

You can use this to schedule in other expenses. Say your car is going to need a warrant soon. That’s over and above your monthly budget, so it would make sense to schedule that in for the day after you get paid for your voice acting job - even if that ends up being a few weeks before the warrant’s up.

Keeping an eye on your cash like this can make your life a lot easier, because you’re matching your incoming payments with your outgoing expenditure, rather than just hoping it all works out.

Finally, IRD are often willing to help accommodate delayed payments or instalment plans. Don’t be afraid to give them a call.

Get that money in the door

If you’re independent, you’re probably invoicing clients. One mistake Mike sees is a tendency for people to wait until a project is completed before they invoice their clients (I know I do this). There’s actually nothing stopping you from invoicing earlier than that - you can invoice a client for work done so far when you complete part of a project, rather than waiting until the end.

This is useful because you’re getting cash into your bank account faster. That’s money you can spend on things you need today, or save as a buffer - or even (god forbid!) earn some interest on it.

On this point, you can also shorten your payment terms. Lots of people have the 20th of the following month as their payment terms. So if you invoice someone on the 21st, you have to wait 29 days to get paid. Not great.

This isn’t a law or anything. You can ask for 10 day payment terms, 7 days or anything you want. The worst your client can do is say no, and if they pay you faster, that’s much better for you.

Stay on top of it, reap the rewards.

As an artist, finances may not be your strong suit. But trust me - it’s better to stay on top of them than to avoid them entirely. Hopefully, these tips help you to keep money coming in and avoid the pitfalls of mismatched income and expenses.

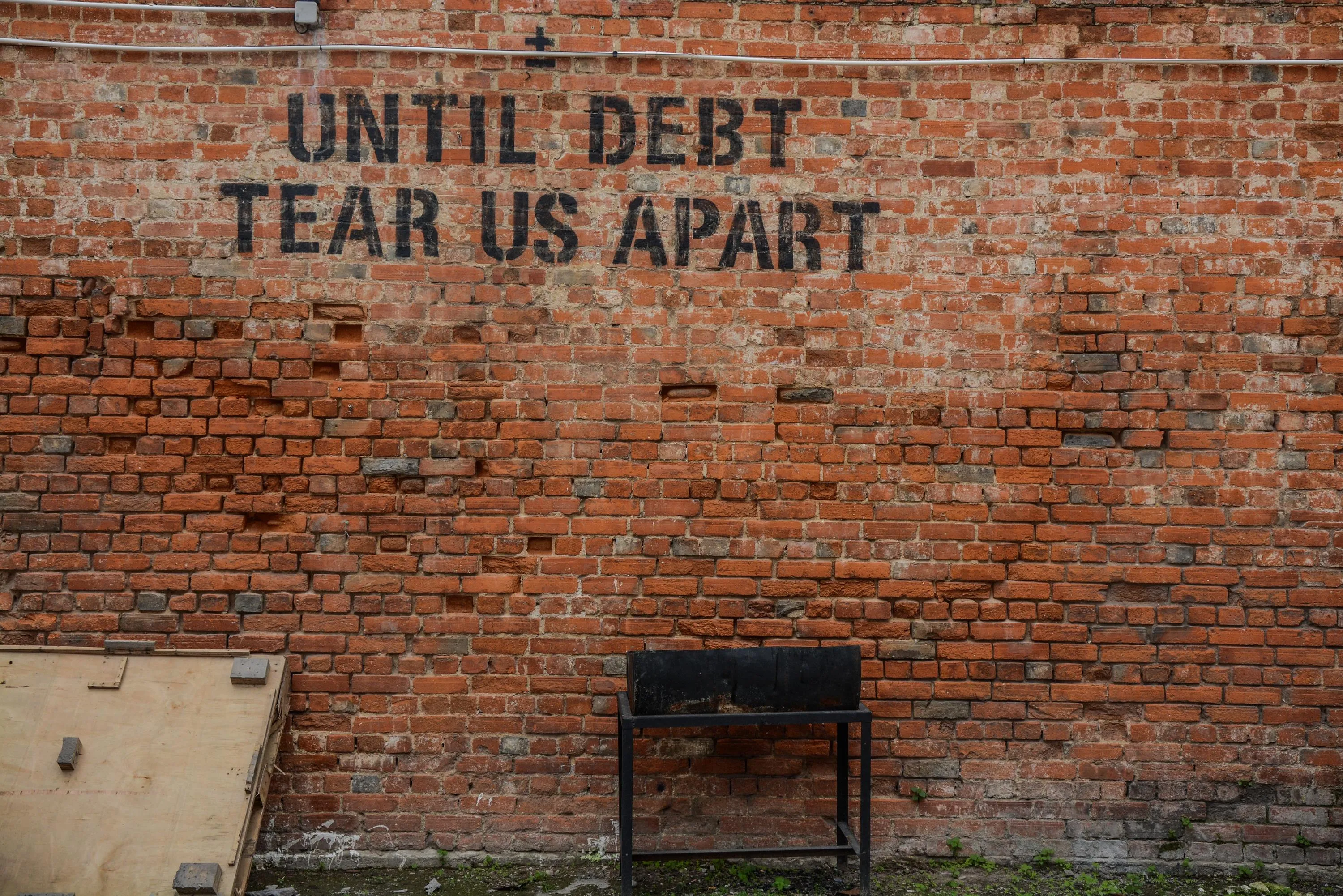

Photo by abigail low on Unsplash