Follow the Money: number-crunching, savings and taxes for artists

We’ve written a lot about making a living as an artist. But what about the other side of that? Once you have money coming in, how do you make sure it gets allocated to the right places?

To get some tips on this, I teamed up with Hnry. Hnry is a service that helps freelancers and self-employed people manage their money. Rather than going to see an accountant, you can log in to Hnry to invoice clients and track your expenses. Then, when you get paid, Hnry automatically takes the tax money you owe out of your income, pays it for you, and gives you the rest. This takes the time, hassle and anxiety out of dealing with your tax obligations - and gives you a nice clean dashboard to keep an eye on your income and expenses.

I talked to Hnry customer and visual artist Ash Church, who goes by the name of Dinosaurtoast, to get some tips about how to manage money when you’re working for yourself.

1: Don’t let your savings ruin your life

Everyone knows that it’s important to save. But you need to be careful not to save too much.

This sounds contradictory - how could you save too much? - but it’s really not. If you save so much money that you have barely enough to live on day-to-day, you’re almost guaranteed to raid your savings account sooner rather than later. This leaves you further behind than if you had just saved a small amount.

Ash puts 10% of her income aside, and this works for her. It’s enough to give her a solid amount of savings, but it’s not so much that she can’t go out to lunch or have a coffee. When you’re saving, you should try to find a similar balance - enough to make a difference, but not so much that you are effectively impoverishing yourself.

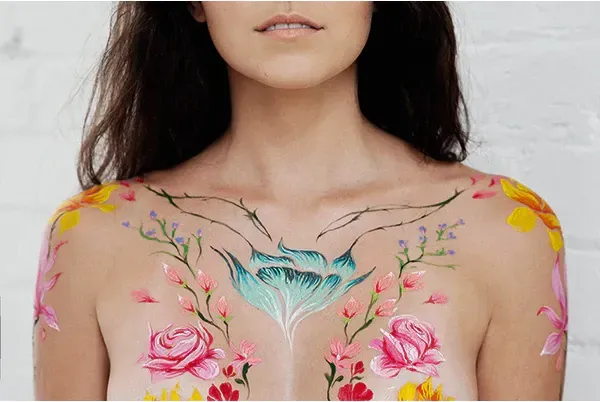

Photo: Dinosaurtoast

2: Put your savings in a separate account

If you work in a “regular job,” you probably don’t even notice your taxes, student loan repayments, ACC levies and Kiwisaver - it all just vanishes before your pay gets to you, and what you’re left with is what you pay your bills with. Ash follows the same principal with her savings. When she gets paid, she immediately transfers her 10% to a dedicated savings account in a completely different bank. This means it doesn’t show up in her online banking, and she can basically forget about it. “I never touch that money,” she said, “because I never see it.”

So while she doesn’t see the money, it’s still working for her, by earning interest in a dedicated bank account - not a bad deal!

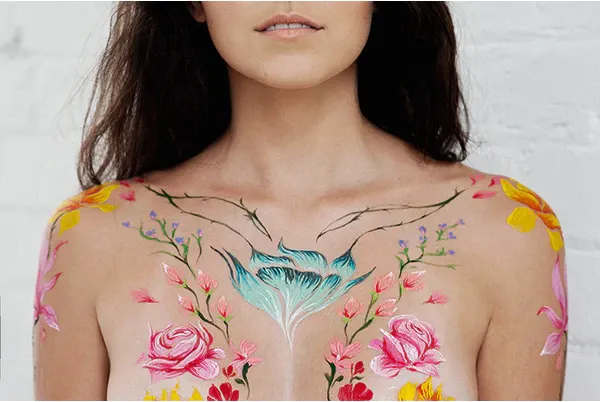

Photo: Dinosaurtoast

3: Beware the provisional tax

Here’s how provisional tax works: you make some money in a financial year. You file a tax return. You pay your taxes. Good stuff. Then, in your second year, the IRD asks for money ahead of time, based on how much you made last year. If they get the estimate wrong, you get a refund later on. Hence: provisional.

The trick here is to stop you getting a massive tax bill at the end of the year, which makes sense- as long as you make the same amount of money in each year. This was not Ash’s experience -“I was all over the place, I didn’t have a set amount of income each week.” She made less money in one year than she did in the year before, so her tax payment that year was larger than the amount she owed based on her earning. So she had to go through the hassle of adjusting it, later. “You get some of it back, but that doesn’t really help at the time.”

To be fair to the IRD, they’ve now changed this system to make it a bit less of an ordeal, but it’s still something to look out for, especially if your income goes up or down a lot. This is often the case with small businesses before they establish a solid cash flow! It’s the sort of thing which can be easily managed, but when left unchecked, it causes more grief, and further costs.

The artist AKA Dinosaurtoast, hard at work on her tax return

4: Get some help if you need it

If you’re self-employed, it may be tempting to do your own taxes. This can work for some people, but take a long look at whether you have the skills to manage this on your own, or not. Be honest with yourself, because the costs of getting it wrong are a lot higher than the costs of getting some help.

Ash used to do her own taxes, but she had a hard time. “It’s just not my thing, I dreaded doing it every time, I just wanted to be creative, not crunch numbers.” This is in spite of the fact that she’s pretty financially savvy - she had a lot of help and support from her dad who literally wrote Fat Wallet, a book for millenials on money management!

That’s why Ash signed up for Hnry, because they manage all that stuff for her. When she gets paid by a client, her money goes straight to Hnry. They take care of any tax she owes, plus ACC, KiwiSaver etc., and pay the remainder straight into her account. She can spend or save that money with no worries about tax, provisional or otherwise. “It’s a great system,” she says, “because it only costs 1% of my total income - definitely worth it.”

She also likes the ongoing relationship with the Hnry team - who personally respond to her questions and feedback.

So whether you use Hnry or another option, make sure you get help when you need it. It’s easy, affordable and can make significant savings. Otherwise you’ll tear your hair out trying to get all your taxes together, and you’ll be anxious all year wondering if you did it right.

You can find out more about Hnry here, or sign up today.

Promoted content.